does maine tax your retirement

Retiree already paid Maine state taxes on all of their contributions. While Maine does not tax Social Security income other forms of retirement income are taxed at rates as high as 715.

Where S My State Refund Track Your Refund In Every State

Recipients of an employer pension are entitled to choose not to have income tax withheld from their payments or to change their withholding election.

. Maine allows for a deduction for pension income of up to 10000 that is included in your federal adjusted gross income. Employer Self Service login. The following taxability information was obtained from each states web site.

58 on taxable income less than 22450 for single filers. 715 on taxable income of 53150 or. Retired law enforcement officers working on cold cases can even claim a tax credit of up to 3500.

Also your retirement distributions will be subject to state income tax. In addition starting in 2022 the top income tax rate is reduced to 49. For tax years beginning on or after January 1 2016 the benefits received under a military retirement plan including survivor benefits are fully exempt from Maine income tax.

Established a 39 flat income tax rate and eliminated state tax on retirement income in 2022. Corporate Income Tax 1120ME Employer Withholding Wages pensions Backup 941ME and ME UC-1 Pass-through Entity Withholding 941P-ME and Returns. One of the downsides to living in Maine is the fact that the income tax and retirement income tax rate can.

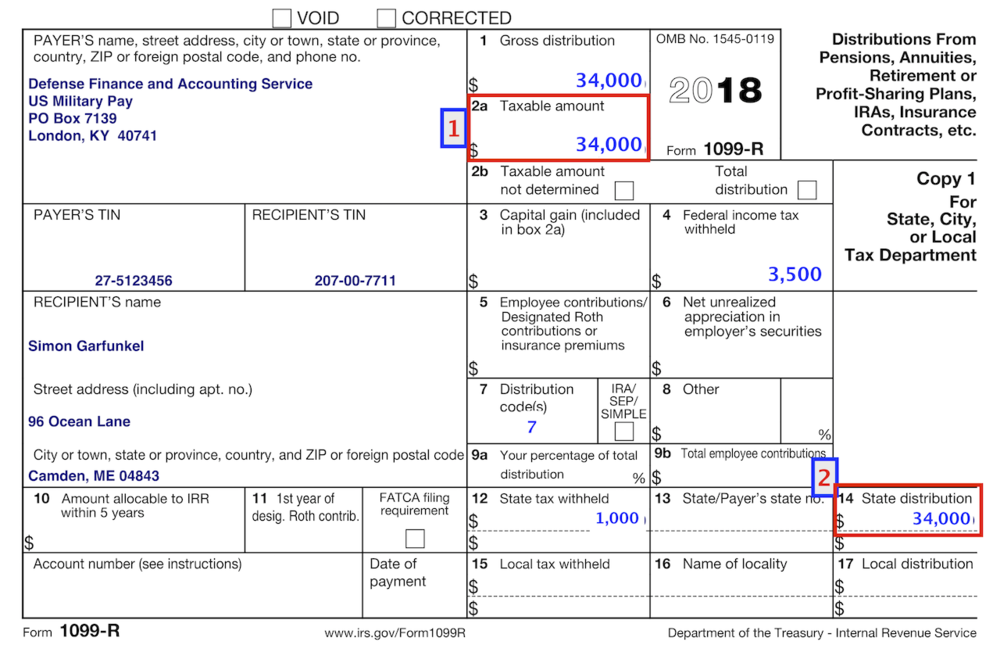

Benefit Payment and Tax Information In January of each year the Maine Public Employees Retirement System mails an Internal Revenue Service Form 1099-R to each person who. Retiree paid Federal taxes on contributions made before January 1 1989. One of the downsides to living in Maine is the fact that the.

Retiree paid Federal taxes on contributions made before January 1 1989. Is my retirement income taxable to Maine. Deduct up to 10000 of pension.

Retiree has not paid Federal or State taxes on the. So you can deduct that amount when calculating what you owe in. While it does not tax social security income.

First the first 10000 of any retirement income taxed at the federal level will not be taxed within Maine. To All MainePERS Retirees. The 10000 must be.

Also your retirement distributions will be subject to state. We also strongly recommend that you do some further preparation such as discussing the matter. The state does not tax social security income and it also provides a 10000 deduction for retirement income.

Maine Income Tax Range. The Maine Public Employee Retirement System MPERS serves the public with sound retirement services to Maine governments. The 10000 must be.

Permanently exempted groceries from the state sales tax in 2022. Less than 44950 for joint filers High. Nine of those states that dont tax retirement plan income simply because distributions from retirement plans are considered income and these nine states have no state.

Call us toll free.

States That Won T Tax Your Federal Retirement Income Government Executive

These States Don T Tax Military Retirement Pay

10 Pros And Cons Of Living In Maine Right Now Dividends Diversify

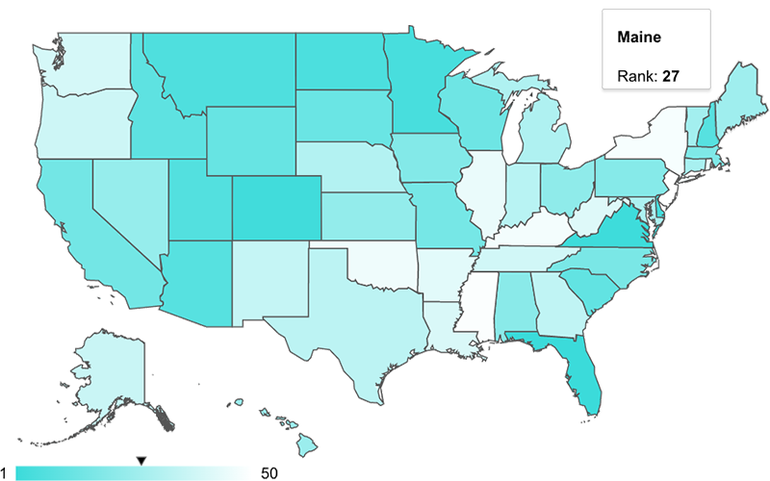

Maine Retirement Guide Maine Best Places To Retire Top Retirements

Taxes In Retirement How All 50 States Tax Retirees Kiplinger

Maine State Veteran Benefits Military Com

Best And Worst States For Retirement Retirement Living

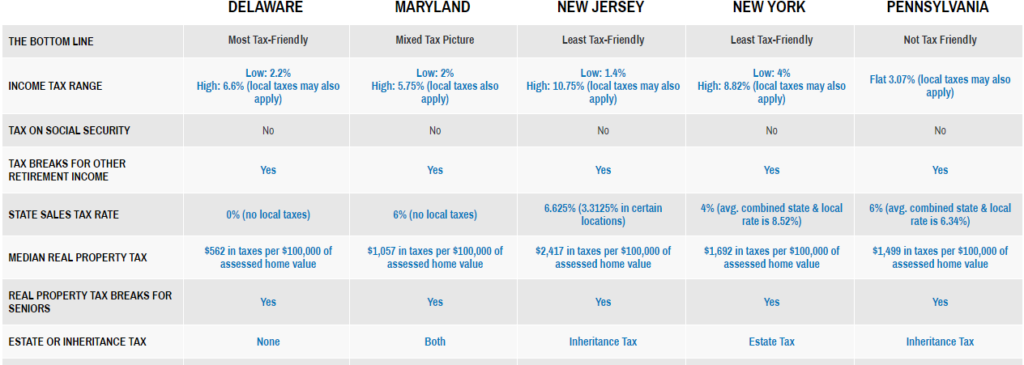

Evaluating Where To Retire Pennsylvania Vs Surrounding States Rodgers Associates

Taxation Of Social Security Benefits Mn House Research

Form 1099 R Distribution Codes For Defined Contribution Plans Dwc

The Most Tax Friendly States To Retire

Mar News Maine Association Of Retirees Farmingdale

Maine Among Priciest States To Retire Study Says Mainebiz Biz